How I Survived a Debt Crisis Without Losing My Mind — and Built Steady Gains

I used to lie awake at night, staring at the ceiling, my mind racing through endless bills and sinking balances. I wasn’t broke — I had income — but my debt kept growing, and I felt trapped. That changed when I stopped chasing quick fixes and started focusing on stability. This is how I turned financial chaos into a predictable, calm system that quietly builds value — even in tough times. The journey wasn’t flashy or fast, but it was real. It relied on discipline, thoughtful planning, and a shift in mindset from reacting to building. What began as a desperate effort to catch up evolved into a sustainable method for managing money — one that prioritizes peace over pressure, consistency over shortcuts, and long-term strength over short-lived wins.

The Breaking Point: When Debt Stops Being Manageable

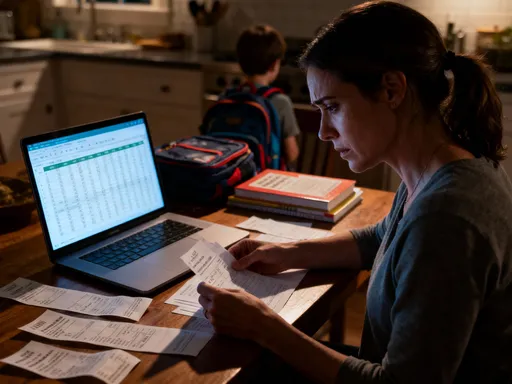

Debt doesn’t always begin with crisis. Often, it starts quietly — a credit card balance here, a delayed car payment there, a few online purchases justified as 'temporary.' For many, including myself, the turning point wasn’t a single event but a slow accumulation of stress that eventually became impossible to ignore. The moment I realized I was in real trouble wasn’t when I missed a payment, but when I started dreading the arrival of each new statement. The numbers no longer reflected choices; they reflected a pattern of survival, not strategy.

What made the situation worse wasn’t just the amount I owed, but the lack of control. I had a steady job and a reliable income, yet every month, after covering essentials and minimum payments, there was nothing left — and still, the balances grew. Interest charges crept in like silent thieves, eroding progress before it could take hold. I began avoiding my bank app, not out of denial, but because each login triggered a wave of anxiety. That emotional burden affected my sleep, my focus at work, and even my relationships. I wasn’t alone in this; studies show that financial stress is one of the leading causes of sleep disruption and emotional strain among working adults, especially women managing household finances.

The real danger in this phase isn’t just the debt itself, but the decisions made under pressure. I considered balance transfer offers with hidden fees, thought about borrowing from retirement accounts, and even entertained high-risk side hustles promising fast returns. Each of these options carried significant risk, and none addressed the root issue: a system that couldn’t sustain progress. The wake-up call came when I mapped out my cash flow and realized that my income wasn’t the problem — my approach was. I was treating symptoms, not the disease. That realization marked the shift from reaction to response, from chaos to calm planning. The first step wasn’t paying down debt; it was rebuilding confidence in my ability to manage it.

Stability Over Speed: Why Slow Gains Win Long-Term Battles

In a world obsessed with speed — instant results, overnight success, rapid transformations — it’s easy to believe that financial recovery must be fast to be effective. But in reality, the most lasting financial progress is rarely explosive. It’s steady. It’s predictable. And it’s built on patience, not pressure. When I began researching ways out of my debt cycle, I was bombarded with messages about aggressive repayment, speculative investing, and high-yield schemes. While these methods work for some under specific conditions, they often increase risk at the very moment stability is needed most.

I learned that chasing high returns while carrying debt is like trying to fill a bucket with a hole in the bottom. Even if you pour faster, you’re still losing more than you gain. Instead, I shifted my focus to what I now call 'quiet growth' — small, reliable gains that compound over time without exposing me to unnecessary volatility. This doesn’t mean giving up on growth; it means redefining what growth looks like. For example, a dividend-paying stock fund yielding 3–4% annually may not sound exciting compared to a cryptocurrency promising 50% returns, but it delivers income consistently, often increases in value over time, and doesn’t require constant monitoring or emotional endurance.

Consider two investors: one who puts $500 into a volatile asset that swings 20% in either direction each year, and another who invests the same amount in a diversified, income-focused portfolio returning 4% annually with low volatility. Over five years, the first investor might experience dramatic highs and crushing lows, possibly ending with less than they started. The second investor, however, sees steady growth — $500 becomes $608 through compounding, with far less emotional toll. More importantly, that steady return can be redirected toward debt reduction, creating a feedback loop of progress. The power isn’t in the speed; it’s in the consistency.

This principle applies beyond investing. When applied to debt repayment, stability means making consistent payments that fit within your budget, even if they’re not the largest possible. It means avoiding the temptation to skip essentials to overpay a card, only to rely on credit again the next month. Slow gains build momentum not through intensity, but through reliability. And in financial recovery, reliability is the foundation of trust — trust in the system, and trust in yourself.

The Anchor Strategy: Building a Core of Predictable Returns

Every strong structure needs a foundation. In personal finance, that foundation is what I call the 'anchor' — a portion of your financial resources dedicated to generating steady, low-risk returns. This isn’t about getting rich quickly; it’s about creating a reliable income stream that supports your broader financial goals, including debt repayment. The anchor acts as a stabilizer, ensuring that even when unexpected expenses arise or income fluctuates slightly, your progress isn’t derailed.

An effective anchor typically includes instruments like high-quality bonds, dividend-focused exchange-traded funds (ETFs), or conservative balanced funds. These assets are chosen not for their potential to skyrocket, but for their ability to deliver consistent returns with minimal downside risk. For instance, investment-grade corporate bonds may yield between 3% and 5% annually, depending on market conditions, and pay interest semi-annually. That income can be automatically reinvested or used to cover a portion of monthly debt payments, creating a self-reinforcing cycle.

Building an anchor starts with allocation — deciding how much of your available capital to dedicate to stability. A common guideline is to allocate between 40% and 60% of investable assets to low-volatility instruments, depending on your risk tolerance and financial stage. If you’re actively paying down high-interest debt, the anchor might be smaller at first, but it should still exist. Even a $1,000 investment in a money market fund earning 3% provides $30 in annual income — not a fortune, but enough to cover a credit card’s minimum payment or contribute to an emergency buffer.

The key is to protect the anchor from being raided during setbacks. That means treating it as a long-term pillar, not a short-term solution. It also means funding it gradually, from surplus income or windfalls like tax refunds, rather than pulling money from essential expenses. Over time, as debt decreases and income stabilizes, the anchor can grow, increasing its income-generating power. This creates what financial planners call a 'virtuous cycle' — where stable returns support debt reduction, which improves cash flow, allowing for larger contributions to stable investments. The result isn’t just financial improvement; it’s increased confidence in your ability to manage money wisely.

Debt Layering: Matching Repayment to Income Rhythms

Most debt repayment advice falls into two camps: the snowball method (paying off smallest balances first) and the avalanche method (targeting highest interest rates). Both have merit, but neither fully accounts for the reality of irregular cash flow, unexpected expenses, or the psychological burden of mismatched timing. I found that neither worked consistently for me until I adopted a more personalized approach — what I call 'debt layering.'

Debt layering is the practice of aligning repayment schedules with your actual income cycles. Instead of forcing a rigid monthly plan onto a variable financial life, it works with the rhythm of your paychecks, side income, and household expenses. The goal is to eliminate the 'shortfall gap' — that dangerous period between income deposits and bill due dates when people often resort to credit cards or overdrafts.

Here’s how it works: First, categorize your debts by urgency and interest behavior. High-interest credit cards (above 15%) are top priority. Installment loans with fixed payments come next. Lower-interest debts, like certain personal loans or medical balances, can be managed with minimum payments for now. Then, map your income — when exactly does your paycheck arrive? Do you receive bonuses, tax refunds, or seasonal income? Align your largest debt payments with the days immediately following income deposits, when your account balance is highest.

For example, if you’re paid biweekly, schedule your credit card payment, student loan, and any other major obligations for the day after each deposit. Automate these transfers so they happen without decision fatigue. Use the rest of the pay period to cover essentials and build a small buffer. This creates a natural rhythm — income in, obligations met, stability maintained. It also reduces the mental load of constantly checking balances or worrying about overdrafts.

Additionally, consider staggering due dates when possible. Many lenders allow you to adjust payment dates to better fit your cycle. Moving a credit card due date to the 5th and a utility bill to the 15th can prevent multiple large payments from hitting at once. This layering effect smooths out the financial landscape, making it easier to maintain consistency. Over time, as debts are paid off, the freed-up payments can be redirected into the anchor or emergency buffer, accelerating progress without increasing strain.

The Buffer Shield: Protecting Progress from Surprises

No financial plan survives contact with reality unchanged. Emergencies happen — a car repair, a medical bill, a home appliance failure. Without protection, these events can undo months of progress, forcing people back into credit card debt or high-interest loans. That’s why a critical component of sustainable recovery is the 'buffer shield' — a small, liquid reserve designed to absorb shocks without disrupting long-term goals.

The buffer shield is not a full emergency fund — that comes later. Instead, it’s a starter defense, typically ranging from $500 to $1,000, kept in a safe, accessible account like a high-yield savings account or money market fund. Its sole purpose is to cover unexpected expenses up to a certain threshold, preventing the need to borrow. Unlike a traditional emergency fund, which might take months to build, the buffer can be funded quickly from windfalls, budget cuts, or a portion of stable returns from the anchor.

Where you place the buffer matters. It should be separate from your checking account to avoid accidental spending, but easy to access when needed. Naming the account something like 'Crisis Cover' or 'Peace of Mind Fund' reinforces its purpose. The rule is simple: only use it for true surprises — not for planned expenses, not for impulse purchases, and not to cover regular shortfalls. After use, prioritize replenishing it before increasing debt payments or investing more heavily.

The psychological benefit of the buffer is immense. Knowing there’s a financial cushion reduces anxiety and prevents panic-driven decisions. It also protects your credit score by avoiding late payments or maxed-out cards during tough months. Over time, as debt decreases and income stabilizes, the buffer can grow into a full emergency fund covering three to six months of essential expenses. But even in its smallest form, it serves as a stabilizing force — a quiet reassurance that you won’t be knocked off course by life’s inevitable bumps.

Behavioral Leverage: Designing Systems That Stick

Motivation is fleeting. Willpower fades. But systems, when designed well, endure. The most powerful tool in my recovery wasn’t a financial product or a complex strategy — it was behavioral design. By structuring my environment to support good habits, I reduced the need for constant decision-making, which in turn reduced mistakes and stress.

One of the most effective changes was automation. I set up automatic transfers from my checking account to my debt payments, buffer shield, and anchor investments on the same day each month — right after payday. This ensured that the most important actions happened before I had a chance to second-guess them. I also separated accounts: one for bills, one for debt repayment, one for savings. This 'mental accounting' made it easier to track progress and avoid mixing purposes.

Visual tracking played a big role too. I created a simple chart showing my total debt decreasing over time, updated monthly. Seeing the line move downward, even slightly, provided a sense of accomplishment that kept me going. I also set 'no-brainer' rules — simple, unbreakable guidelines like 'no new credit card spending' or 'every bonus goes to debt or the buffer.' These rules eliminated debate in the moment, making compliance automatic.

Another key was reducing friction. If saving required logging into an app, transferring funds, and confirming — it often didn’t happen. But when it was automated, it happened every time. The same principle applied to spending: I unsubscribed from retail emails, removed saved payment info from shopping sites, and used cash for discretionary categories. These small barriers didn’t eliminate spending, but they slowed it down enough to allow reflection.

Behavioral leverage isn’t about perfection; it’s about making the right choice the easy choice. Over time, these systems became habits — not because I was disciplined, but because the environment made discipline unnecessary. That’s the secret to long-term success: don’t rely on willpower. Build a system that works even when you’re tired, stressed, or distracted.

From Crisis to Calm: Rebuilding Financial Confidence

Looking back, the most significant change wasn’t the number on my credit card statement — though that mattered. It was the shift in how I felt about money. Where once there was dread and helplessness, there is now calm and control. The transformation didn’t happen overnight, and it didn’t require drastic measures. It came from consistent, thoughtful actions — prioritizing stability, building systems, and protecting progress.

Today, my finances aren’t perfect. I still have obligations, and life still brings surprises. But I face them differently. I no longer panic at the sight of a bill. I trust my system. I know that my anchor is working, my payments are aligned, and my buffer can handle most setbacks. That sense of security is priceless — more valuable than any short-term gain.

The journey taught me that financial health isn’t about wealth accumulation alone. It’s about peace of mind. It’s about knowing you can handle what comes, not because you have unlimited resources, but because you have a reliable plan. Success isn’t measured in dollars earned, but in confidence regained — in the quiet satisfaction of sleeping through the night, knowing you’re on solid ground.

For anyone feeling trapped by debt, the path forward doesn’t require a windfall or a miracle. It requires a shift in focus — from speed to stability, from reaction to design, from fear to faith in a well-built system. You don’t have to be rich to be secure. You just have to be consistent. And with the right approach, even the deepest debt crisis can become the foundation for lasting financial calm.