How I Turned My Mortgage Into a Wealth-Builder Without Risking a Dime

What if your mortgage wasn’t just a debt, but a hidden engine for wealth? I used to see my monthly payment as a black hole—until I discovered smarter strategies. With the right approach, paying off a home loan can actually boost your financial growth. This is how I restructured my mortgage plan to cut costs, gain flexibility, and quietly increase my net worth—all while staying safe and in control. It didn’t require risky investments, complex financial products, or a sudden windfall. Instead, it relied on thoughtful planning, disciplined execution, and a shift in mindset: from seeing my mortgage as a burden to recognizing it as a powerful financial tool.

The Hidden Cost of Passive Mortgage Payments

For years, like millions of homeowners, I treated my mortgage as a fixed obligation—something to pay on time and forget about. Each month, the same amount left my account, split between principal and interest, with little attention to how it was structured or what alternatives might exist. This passive approach is common, but it comes with a hidden cost. When you pay your mortgage on autopilot, you miss opportunities to reduce interest, improve cash flow, and align your debt repayment with your broader financial goals. The difference between simply paying and actively managing your mortgage can amount to tens of thousands of dollars over the life of the loan.

Consider two homeowners with identical loans: $400,000 at 4.5% interest over 30 years. One pays the minimum each month without deviation. The other makes small, strategic adjustments—like increasing payments by 10% every few years or making lump-sum contributions when possible. Over time, the second homeowner saves more than $60,000 in interest and pays off the loan nearly five years earlier. This isn’t due to higher income or luck—it’s the result of awareness and intentionality. The first homeowner treats the mortgage as a bill; the second treats it as a financial lever.

The key distinction lies in understanding that not all debt management is equal. Paying off a mortgage slowly, without optimization, means you’re effectively overpaying for the privilege of homeownership. Inflation erodes the real value of money over time, but interest compounds, and banks profit from long repayment periods. By remaining passive, you allow the financial system to work against you. The solution isn’t to eliminate debt at all costs but to manage it wisely—using tools, timing, and structure to your advantage. Awareness is the first step toward transformation.

Rethinking Debt: When a Mortgage Can Work for You

Many people operate under the belief that all debt is bad—a financial trap to be avoided or eliminated as quickly as possible. While high-interest consumer debt like credit cards should indeed be prioritized for repayment, not all debt carries the same weight. A mortgage, particularly one with a low or fixed interest rate, is fundamentally different. It is secured against an appreciating asset—your home—and often comes with favorable tax treatment in many countries. When managed strategically, a mortgage can free up capital for other productive uses, making it a tool for wealth building rather than a drain.

The concept of opportunity cost is central here. Every dollar you allocate to early mortgage repayment is a dollar not available for other investments. If your mortgage carries an interest rate of 4%, but you can earn 6% annually through a diversified portfolio of index funds, then redirecting excess funds toward investments—rather than the loan—creates a net gain. This doesn’t mean you should avoid paying down your mortgage altogether; it means evaluating each financial decision in context. The goal is not to eliminate debt at any cost, but to optimize your overall financial position.

One practical way to achieve this balance is through a strategy known as the ‘mortgage surplus redirect.’ Instead of making extra payments toward the principal, you deposit surplus funds into a high-yield savings account or a short-term investment vehicle. This keeps the money liquid and available for opportunities—such as home improvements that increase property value, education, or unexpected expenses—while still reducing the effective cost of borrowing. Over time, this approach builds financial flexibility and resilience. The mortgage remains on track, but your overall net worth grows faster because your money is working harder.

This shift in perspective—from fear of debt to strategic use of leverage—can be empowering. It allows homeowners to stop viewing their mortgage as an enemy and start seeing it as part of a larger financial ecosystem. When debt is low-cost, secured, and manageable, it becomes a bridge to greater financial freedom rather than a chain.

Leveraging Equity Without Losing Control

Home equity—the difference between your home’s market value and the outstanding mortgage balance—is one of the most underutilized assets in personal finance. For many, it’s an abstract number on a yearly statement, not a source of financial strength. Yet when accessed prudently, equity can be a powerful tool for reducing interest, improving cash flow, and funding growth-oriented goals. The key is to use it wisely, without exposing yourself to unnecessary risk.

One of the safest and most effective ways to leverage equity is through an offset account. This is a transaction account linked to your mortgage, where the balance reduces the amount of principal on which interest is calculated. For example, if you have a $300,000 mortgage and $50,000 in an offset account, you only pay interest on $250,000. The money in the offset account remains fully accessible, unlike funds paid directly toward the principal. This provides the dual benefit of interest savings and liquidity. Even if you don’t make extra mortgage payments, the offset account acts like a continuous repayment tool, compounding savings over time.

Another method is strategic use of a redraw facility, which allows you to make additional repayments and withdraw them later if needed. This is particularly useful for those with irregular income—such as freelancers or seasonal workers—who may have surplus cash in certain months. By making larger payments when possible and accessing those funds during leaner periods, they maintain financial stability while still reducing overall interest. The redraw feature turns the mortgage into a flexible financial instrument, not a rigid obligation.

It’s important to emphasize that leveraging equity should never involve speculative behavior. Taking out a home equity loan to invest in volatile assets or fund luxury purchases increases risk and undermines financial security. The goal is optimization, not gambling. When used to reduce interest, improve cash flow, or fund value-adding home improvements, equity becomes a silent partner in wealth creation. It’s not about borrowing more—it’s about using what you already have more effectively.

The Timing Puzzle: When to Accelerate, When to Wait

There’s a common belief that the fastest way to financial freedom is to pay off your mortgage as quickly as possible. While this approach brings emotional satisfaction and eliminates debt sooner, it’s not always the most financially optimal choice. The decision to accelerate repayment should be based on a careful analysis of interest rates, investment returns, inflation, and personal financial goals. Sometimes, waiting or maintaining a steady pace can lead to greater long-term wealth.

Inflation plays a crucial role in this equation. Over time, the real value of money decreases, meaning that a fixed mortgage payment becomes relatively cheaper in real terms. A $2,000 monthly payment today may feel significant, but in 15 years, due to inflation, it will represent a smaller portion of your income and purchasing power. By keeping the mortgage longer and investing surplus funds elsewhere, you allow your money to grow at a rate that potentially outpaces both inflation and your loan’s interest rate. This doesn’t mean neglecting the debt—it means being strategic about the timing of repayment.

Consider a homeowner with a 3.8% mortgage rate and access to a diversified investment portfolio averaging 6% annual returns. If they have $10,000 in surplus funds, putting it toward the mortgage guarantees a 3.8% return (by reducing interest). However, investing it offers a higher expected return. While investments carry market risk, a well-diversified portfolio over the long term has historically outperformed mortgage interest rates. Therefore, delaying extra payments in favor of investment can be a rational choice, especially in low-interest-rate environments.

Tax considerations can also influence timing. In some countries, mortgage interest is tax-deductible, particularly for investment properties or home offices. In such cases, maintaining a mortgage may provide ongoing tax benefits that outweigh the cost of interest. Even for primary residences, where deductions may not apply, the opportunity cost of early repayment remains a critical factor. The optimal strategy is not one-size-fits-all—it depends on your financial situation, risk tolerance, and long-term goals. The goal is balance: paying down debt responsibly while allowing your money to work for you.

Cash Flow Engineering: Aligning Income with Debt Cycles

One of the most overlooked aspects of mortgage management is the timing of income and expenses. Most people set up automatic monthly payments without considering when their income arrives. Yet, aligning your cash flow with your payment schedule can create significant financial advantages. This practice, known as cash flow syncing, involves matching extra payments with periods of higher income—such as bonuses, tax refunds, or side business earnings—to maximize impact without straining your budget.

For example, a teacher who receives a lump-sum payment at the end of the school year can use a portion of that income to make a one-time mortgage overpayment. Even a $3,000 contribution can reduce the loan term by several months and save thousands in interest over time. Similarly, someone who receives an annual bonus can direct a percentage toward the mortgage through a redraw facility or offset account. These targeted actions, repeated over years, compound into substantial savings.

Another effective strategy is to make fortnightly rather than monthly payments. By paying half the monthly amount every two weeks, you end up making 26 half-payments per year—equivalent to 13 full monthly payments. This simple change results in one extra payment annually, accelerating repayment without requiring a significant budget overhaul. It works with your natural income rhythm, especially if you’re paid biweekly, and creates momentum without noticeable sacrifice.

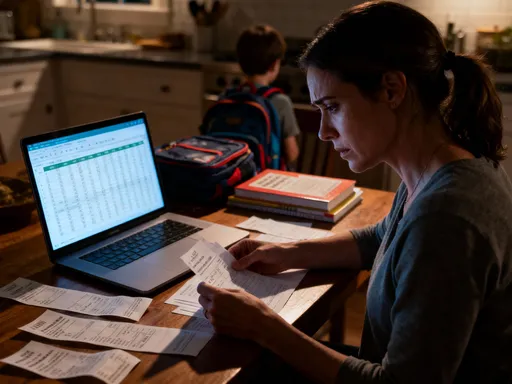

Cash flow engineering also includes setting up separate savings buckets for irregular expenses—like property taxes or home maintenance—so they don’t disrupt your mortgage plan. By automating transfers to these accounts each pay period, you maintain stability and avoid dipping into mortgage funds. This holistic approach ensures that your mortgage strategy isn’t derailed by unexpected costs. When income and obligations are aligned, financial management becomes smoother, more predictable, and more effective.

Risk Control: Protecting Your Plan from Surprises

No financial strategy is complete without a strong focus on risk control. The goal of turning your mortgage into a wealth-building tool is not to maximize speed or returns at all costs, but to do so safely and sustainably. Life is unpredictable—job changes, medical emergencies, or economic downturns can disrupt even the best-laid plans. That’s why building resilience is essential. A robust mortgage strategy includes buffers, safeguards, and flexibility to withstand unexpected challenges.

The foundation of risk control is an emergency fund. Financial experts generally recommend saving three to six months’ worth of living expenses in a liquid, easily accessible account. This fund acts as a shock absorber, allowing you to continue mortgage payments during periods of income loss without resorting to high-interest debt or forced property sales. Without this buffer, even a minor setback can spiral into a financial crisis. The emergency fund is not an optional extra—it’s a critical component of any responsible debt management plan.

Insurance is another key layer of protection. Homeowners insurance, income protection, and mortgage repayment insurance can all help safeguard your financial position. While no one likes to think about worst-case scenarios, having coverage in place ensures that a sudden illness or accident doesn’t derail years of progress. These policies are not investments, but they provide peace of mind and financial continuity when they’re needed most.

Loan structure also plays a role in risk management. Choosing a mortgage with flexible terms—such as the ability to make extra payments, access redraw funds, or switch between fixed and variable rates—gives you control in changing circumstances. Avoiding excessive leverage, such as borrowing at the maximum limit, ensures you have room to maneuver if interest rates rise or income decreases. The goal is not to eliminate all risk—this is impossible—but to manage it wisely. A resilient plan allows you to stay on track even when life doesn’t go according to plan.

From Homeownership to Wealth Building: The Bigger Picture

Managing a mortgage wisely is not just about saving on interest or paying off a loan faster—it’s about laying the foundation for long-term financial health. Every decision you make around your home loan sends a ripple through your broader financial life. When you treat your mortgage as a strategic asset, you cultivate discipline, awareness, and intentionality—qualities that extend far beyond debt repayment. These habits become the building blocks of lasting wealth.

Disciplined mortgage planning teaches you to think in terms of trade-offs, opportunity costs, and long-term consequences. It encourages you to ask not just “Can I afford this payment?” but “What is the best use of this money?” This mindset shift is transformative. It moves you from reactive financial behavior—paying bills and reacting to crises—to proactive wealth creation. Over time, the skills you develop in managing your mortgage—budgeting, optimizing cash flow, balancing risk and return—can be applied to investing, retirement planning, and estate management.

Moreover, becoming mortgage-smart builds confidence. Many people feel overwhelmed by financial complexity, but mastering one major obligation can empower you to take control of others. As your net worth grows—not just from home appreciation but from smarter financial choices—you gain options. You may choose to downsize later in life, use equity to fund retirement, or leave a legacy for your family. The choices become yours, not dictated by debt or circumstance.

The journey from passive homeowner to active wealth builder doesn’t require extreme measures. It begins with small, consistent actions: reviewing your loan terms, setting up an offset account, aligning payments with income, and building emergency savings. These steps, taken together, create a powerful compounding effect. Over time, what once seemed like an inescapable debt becomes a cornerstone of financial freedom. Your mortgage, once a source of stress, transforms into a quiet engine of growth—proving that with the right approach, even the most ordinary financial tools can deliver extraordinary results.