What I Wish I Knew About Money When I Lost My Job

Losing a job doesn’t just shake your income—it rattles your entire sense of stability. I remember staring at my bank account, heart pounding, wondering how I’d keep up with rent and bills. That’s when I realized: emergency planning isn’t optional. What saved me wasn’t luck, but the right financial tools and a clear strategy. If you’re facing uncertainty, this is your roadmap to staying afloat—without panic, guesswork, or false promises. The experience taught me that financial resilience isn’t built in crisis, but long before it arrives. This is what I wish I had known earlier, and what you can start applying today.

The Wake-Up Call: When Income Stops, Reality Hits

When the paycheck stops, the emotional impact is immediate. Even if the job loss was expected, the reality of no income can feel like stepping off a cliff. Many people enter a state of shock—denial, disbelief, or a temporary freeze in decision-making. Bills don’t pause, however, and rent, insurance, and groceries continue to demand payment. The first few days are critical. How you respond during this window shapes your financial trajectory for months to come. Panic leads to poor choices: withdrawing retirement funds, maxing out credit cards, or making impulsive spending cuts that harm long-term well-being. The alternative is a calm, structured approach—one that prioritizes clarity over reaction.

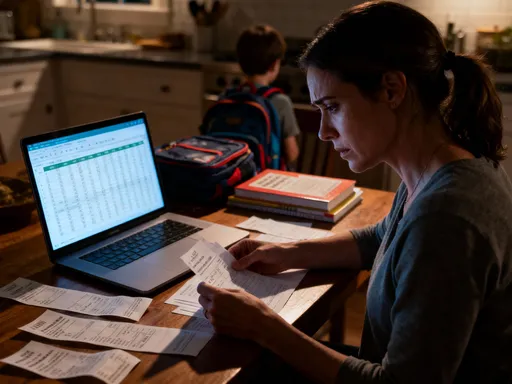

Financial stress is not just about numbers; it’s deeply psychological. The loss of a job often feels like a loss of identity or purpose. For many women in their 30s to 50s, especially those managing households or caring for aging parents, this burden is compounded. There’s pressure to maintain normalcy for children, to avoid burdening a partner, or to hide financial strain from family. These emotional layers make it harder to assess the situation objectively. Yet, the sooner you name the problem, the faster you can solve it. Acknowledging the loss, accepting the uncertainty, and committing to action are the first steps toward regaining control.

Consider the case of Sarah, a 42-year-old administrative manager from Ohio, laid off during a corporate restructuring. At first, she told no one—not even her husband—believing she’d find another role within weeks. She kept spending as usual, assuming a quick rebound. By month two, credit card debt had climbed, and anxiety was affecting her sleep. Only then did she create a crisis budget and apply for unemployment benefits. Her story is common. The gap between expectation and reality often widens in silence. The key is to treat job loss not as a personal failure, but as a financial event—one that requires immediate triage, not shame.

What separates those who recover quickly from those who spiral is preparation. Those with even a small buffer report lower stress levels and make more rational decisions. They buy time to search for the right opportunity, not just any job. They avoid high-cost borrowing and preserve credit. The lesson is clear: the moment income stops, your focus must shift from lifestyle maintenance to financial survival. This isn’t defeat—it’s strategy. And the foundation of that strategy begins with your emergency fund.

Emergency Fund: Your First Line of Defense

An emergency fund is not a luxury—it’s the cornerstone of financial security. Think of it as a personal insurance policy, designed to cover unexpected gaps in income or sudden expenses. When you lose your job, this fund becomes your primary source of stability. It’s what allows you to pay the mortgage, buy groceries, and keep the lights on without resorting to debt. Without it, every financial decision becomes reactive and high-pressure. With it, you gain breathing room—time to think, plan, and act with intention.

Many people misunderstand what an emergency fund is and how it should be used. It is not the same as retirement savings, a vacation fund, or a down payment account. It exists solely for true emergencies—job loss, medical bills, urgent home repairs. It should be kept separate from everyday checking accounts to avoid accidental spending. The ideal emergency fund covers three to six months of essential living expenses. However, this number isn’t one-size-fits-all. A single mother with two children and a fixed rent payment may need closer to six months. A dual-income couple with flexible housing options might manage with three. The goal is to calculate your own baseline: what do you absolutely need to survive each month?

To determine your target, list all essential expenses: housing, utilities, food, transportation, insurance, and minimum debt payments. Exclude discretionary spending like dining out, subscriptions, or shopping. Multiply that total by the number of months you want to cover. If your essentials total $3,000 per month and you aim for four months, your target is $12,000. This figure may feel daunting, but it doesn’t have to be built overnight. Consistent, automatic transfers—even $50 or $100 per month—add up over time. The key is starting, no matter how small.

But what if you don’t have an emergency fund? You’re not alone. Studies show that nearly half of American households couldn’t cover a $400 emergency without borrowing or selling something. If you’re in this position, the priority shifts to damage control and immediate income replacement. Apply for unemployment benefits, explore temporary work, and reduce spending aggressively. At the same time, begin building a micro-emergency fund—start with $500, then $1,000. Even a small cushion can prevent a minor setback from becoming a crisis. The goal is progress, not perfection. Every dollar saved now strengthens your future self.

Budget Triage: Cutting Smart, Not Just Deep

When income drops, the natural instinct is to cut spending. But not all cuts are equal. Drastic measures—like stopping all grocery shopping or canceling essential prescriptions—aren’t sustainable and can harm health and morale. The smarter approach is budget triage: identifying which expenses are truly essential and which can be reduced or paused without long-term consequences. This isn’t about deprivation; it’s about strategic reallocation. The goal is to stretch your available funds as far as possible while maintaining dignity and well-being.

Start by categorizing your spending into three groups: non-negotiable essentials, flexible essentials, and non-essentials. Non-negotiables include rent or mortgage, utilities, basic groceries, and necessary medications. These cannot be eliminated without serious risk. Flexible essentials—like transportation, internet, and phone service—can often be adjusted. For example, switching to a lower-cost phone plan, using public transit instead of gas, or negotiating a temporary reduction with your provider. Non-essentials are subscriptions, dining out, entertainment, and luxury items. These are the first to go in a crisis.

Many people overlook recurring charges that drain accounts silently. Streaming services, gym memberships, software subscriptions—these small monthly fees add up. One woman reviewed her bank statements and found $80 in forgotten subscriptions. Canceling them freed up nearly $1,000 per year. Another common leak is grocery spending. Switching to store brands, buying in bulk, using coupons, and planning meals can reduce food costs by 20% or more. Utility bills can also be lowered through simple changes: adjusting the thermostat, using energy-efficient bulbs, and reducing water usage.

It’s also important to distinguish between essential spending and “emotionally essential” spending—things that feel necessary for mental health but aren’t strictly required. For some, this might be a weekly coffee, a therapy session, or a small gift for a child. These aren’t frivolous; they support emotional resilience. The key is to identify them consciously and protect a small portion of the budget for them. Denying all joy leads to burnout. Instead, redefine what’s affordable. A $5 coffee can become a homemade latte. A dinner out can become a family game night. The goal is balance—preserving mental health while honoring financial limits.

Liquidity Over Returns: Why Access Beats Growth Now

When you’re employed and stable, growing wealth is a priority. Investments in stocks, retirement accounts, or real estate make sense because time is on your side. But when you lose your job, the priority shifts from growth to access. You need money you can use immediately, without penalties or delays. This is the principle of liquidity: how quickly and easily you can turn an asset into cash. In a crisis, a high-return investment locked in a long-term account is useless if you can’t reach it. What matters most is safe access.

Consider the difference between a 401(k) and a high-yield savings account. The 401(k) may offer strong long-term returns, but early withdrawals come with taxes and penalties. It’s not designed for emergencies. A high-yield savings account, on the other hand, offers modest interest but full access. You can transfer funds instantly, without fees or consequences. During unemployment, this flexibility is invaluable. It allows you to cover bills while your job search continues. The same applies to CDs, bonds, or real estate—illiquid assets may be valuable, but they’re not helpful in the short term.

This doesn’t mean abandoning investment goals forever. It means pausing them temporarily. If you’re contributing to a retirement account, consider reducing or suspending contributions until income resumes. The market will still be there later. What won’t be there is your credit score if you miss payments or your peace of mind if you’re constantly worried about cash flow. The goal now is stability, not growth. Once employment returns, you can restart contributions and rebuild investment momentum.

Liquidity also applies to debt. Avoid locking yourself into long-term loans or high-interest credit. If you must borrow, choose options with clear terms, low rates, and flexible repayment. A personal line of credit, for example, allows you to draw only what you need, when you need it, and pay interest only on the amount used. This is far better than maxing out a credit card with a 25% interest rate. The principle is simple: in a crisis, prioritize access, safety, and control over high returns or long-term gains.

Financial Tools That Actually Help (And Which Ones Don’t)

Not all financial tools are created equal, especially in a crisis. Some provide real support; others deepen the problem. Knowing the difference can protect your future. The most effective tools during unemployment are those that offer low-cost access to cash, flexibility, and transparency. High-yield savings accounts, credit unions, and cash management apps fall into this category. They are designed for safety and ease of use. Many credit unions, for example, offer lower fees, higher savings rates, and more personalized service than large banks. They may also provide hardship programs, such as loan deferments or fee waivers, for members in need.

Cash management apps—like those offered by fintech companies—can help track spending, automate savings, and identify waste. Some even offer early paycheck access or small no-fee advances. These features can bridge short gaps without resorting to predatory lending. However, always read the terms. Some apps charge hidden fees or encourage overdrafts. The best ones are transparent, fee-free, and focused on financial health, not profit from user mistakes.

On the other hand, certain tools should be avoided at all costs. Payday loans are the most dangerous. They offer quick cash but come with astronomical interest rates—sometimes exceeding 400% annually. A $500 loan can balloon to over $700 in just two weeks. Many borrowers get trapped in cycles of debt, rolling over loans repeatedly. Similarly, cash-out refinancing—tapping home equity to cover living expenses—is risky. It turns unsecured debt into secured debt, putting your home at risk if you can’t repay. Title loans, pawnshops, and high-interest personal loans carry similar dangers.

A better alternative is a personal line of credit from a reputable bank or credit union. It offers lower rates, predictable payments, and no collateral. Another option is borrowing from family or friends, but only with clear terms and written agreements to avoid relationship strain. The key is to evaluate any financial tool by asking: Does it give me control? Is the cost transparent? Can I repay it without risk? If the answer is no, walk away. Your financial recovery depends on avoiding long-term damage.

Bridging the Gap: Temporary Income and Government Support

While cutting expenses is important, increasing income is equally critical. Even small amounts of temporary income can reduce the drain on savings and shorten the financial crisis. The gig economy offers many options: rideshare driving, delivery services, online tutoring, freelance writing, or virtual assistance. These roles often have low barriers to entry and flexible hours, making them ideal for someone managing family responsibilities. Platforms like ride-sharing or food delivery can generate a few hundred dollars a week with minimal setup. Freelance skills—such as bookkeeping, graphic design, or translation—can be monetized on sites like Upwork or Fiverr.

For those with specialized knowledge, consulting or coaching can provide higher earnings. A former teacher might offer test prep; a nurse could provide health education. These roles build on existing expertise and can often be done remotely. The key is to start small and scale as time allows. Even a few hours a week can make a difference. The goal isn’t to replace a full-time salary immediately, but to create a buffer while focusing on long-term job search.

Government support programs are another vital resource. Unemployment insurance is the most well-known. It provides partial wage replacement for those who lost jobs through no fault of their own. Benefits vary by state but typically cover about half of previous earnings for up to 26 weeks. The application process can be confusing, but many states offer online portals and customer support. It’s important to apply as soon as possible—delays can cost weeks of benefits.

Other programs include the Supplemental Nutrition Assistance Program (SNAP), which helps with food costs, and LIHEAP, which assists with heating and cooling bills. Some states offer rental assistance or utility payment plans for unemployed residents. These aren’t handouts; they’re structured supports designed to keep families stable during tough times. Eligibility depends on income, household size, and other factors, but many who qualify don’t apply due to stigma or misinformation. There’s no shame in using available resources. They exist to help people rebuild, not to create dependency.

Rebuilding With Confidence: From Survival to Stability

Job loss is a crisis, but it can also be a catalyst for positive change. Once income resumes, the focus shifts from survival to rebuilding. This is the time to reassess financial goals, strengthen systems, and create long-term resilience. Start by reviewing what worked and what didn’t during the crisis. Did your emergency fund last? Were there spending leaks you didn’t see before? What tools helped the most? Use these insights to refine your financial plan.

Rebuild your emergency fund as a top priority. If you dipped into it, create a repayment plan. Even setting aside $100 a month can restore it within a year. Consider increasing the target to six months, especially if your job market is volatile. Automate transfers so savings happen without effort. At the same time, revisit your budget. Keep some of the spending habits you developed—like cooking at home or using coupons. These aren’t temporary fixes; they’re smart financial practices.

Re-entering the job market is also an opportunity to think differently. Look for roles with better stability, growth potential, or remote options that increase flexibility. Consider upskilling through free or low-cost online courses in areas like digital literacy, project management, or healthcare support. Many community colleges and nonprofits offer training programs for mid-career professionals. Investing in skills now can prevent future job loss.

Finally, cultivate a mindset of preparedness. Financial peace isn’t about having a lot of money—it’s about having a plan. It’s knowing that even if the worst happens, you have the tools to respond. That confidence changes how you live. You sleep better. You make calmer decisions. You model resilience for your family. The goal isn’t to avoid hardship—life will always have surprises—but to face them with strength, not fear. What I wish I knew when I lost my job is that preparation isn’t paranoia. It’s power.